The short answer is: Yes. Lost in the headlines around large year-over-year growth in both the number of transactions and median sales prices is the fact that existing-home sales transactions have declined month-over-month for 3 straight months. This trend seems likely to continue when May data is released later in June as April pending home sales transactions (which tend to predict May closings) was down over 4% compared to March.

Here's Why That Matters: Fannie Mae's Case for Zero Growth in Housing Market Over Next 18 Months

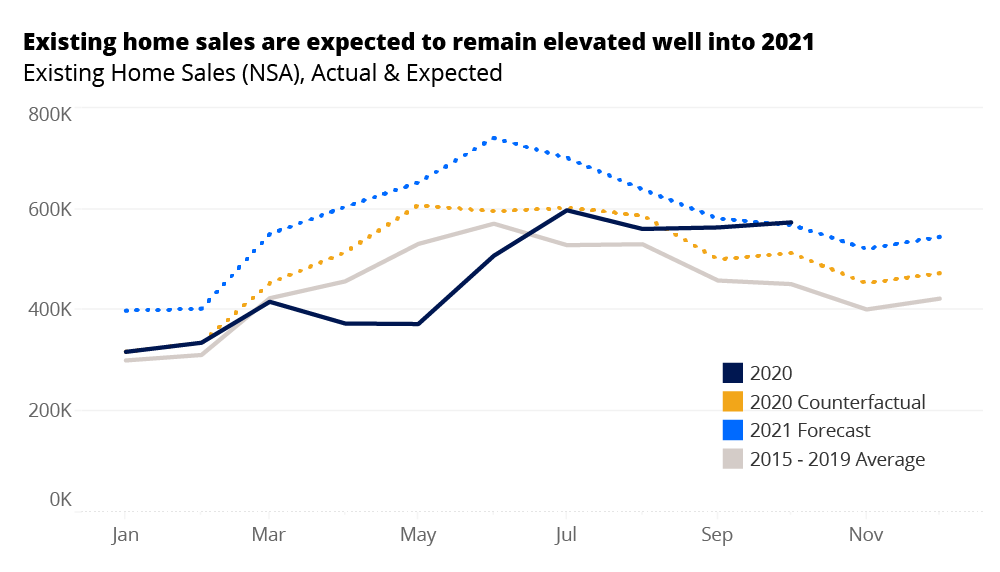

At the beginning of the year, popular sentiment held that the housing market boom from the second half of 2020 would continue uninterrupted throughout 2021. Zillow predicted the largest growth in existing home sales since the '80s, projecting a 21.9% growth year-over-year in 2021.

In order for this to happen, Zillow predicted that existing home sales transactions would peak at a seasonally adjusted rate of 7.01 million in April '21.

Source: Zillow https://www.zillow.com/research/november-2021-sales-forecast-28499/

Source: Zillow https://www.zillow.com/research/november-2021-sales-forecast-28499/

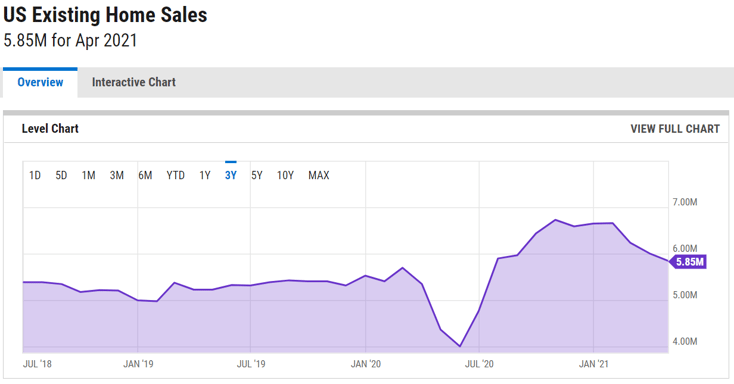

Actual April existing-home sales data according to NAR came in at a seasonally adjusted annual rate of 5.85 million, 16% less than what Zillow predicted. This is a big deal because (as you can see in the chart above) the comparables for the second half of the year 2020 are much higher. In reality, it now looks like the market (from a sales volume standpoint based on the chart below) peaked in October '20, stayed roughly flat through Jan '21, and then has been in decline since.

Source: NAR & ycharts.com https://ycharts.com/indicators/us_existing_home_sales

Source: NAR & ycharts.com https://ycharts.com/indicators/us_existing_home_sales

All this is to stay, the case for the continuation of an uninterrupted housing boom throughout 2021 seems less and less likely.

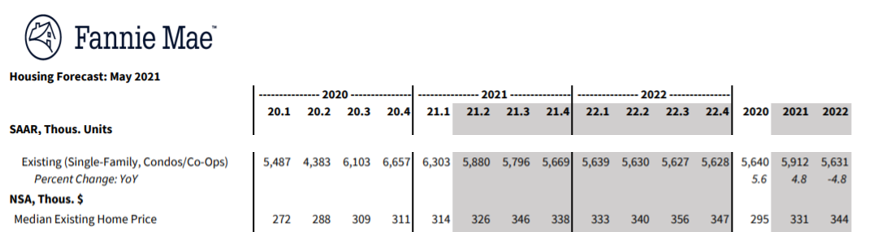

On the other hand, Fannie Mae's predictions thus far have been much more accurate as their Q1 '21 prediction of 6.27MM existing home sales (seasonally adjusted annual rate) was only 0.6% off of the actual number 6.30MM existing homes sold in Q1 '21.

As such, it is worth looking at their updated May 2021 predictions for 2nd half of 2021 and full year 2022:

-

2nd Half of 2021

-

Existing Home Sales (Trxn's) -10% decline year-over-year

-

Median Existing Home Price: +10% growth year-over-year

-

-

Fully Year 2022

-

Existing Home Sales (Trxn's) -5% decline year-over-year

-

Median Existing Home Price: +4% growth year-over-year

-

Source: Fannie Mae https://www.fanniemae.com/media/39411/display

Source: Fannie Mae https://www.fanniemae.com/media/39411/display

Fannie is basically predicting zero growth for the next 18 months as price increases will be washed out by lower transaction volume numbers.

Tracking Fannie Mae's Prediction of Zero Growth in Housing Market vs. Current Trends

Fannie Mae's main reason for revising their forecast downward this Spring was due to:

-

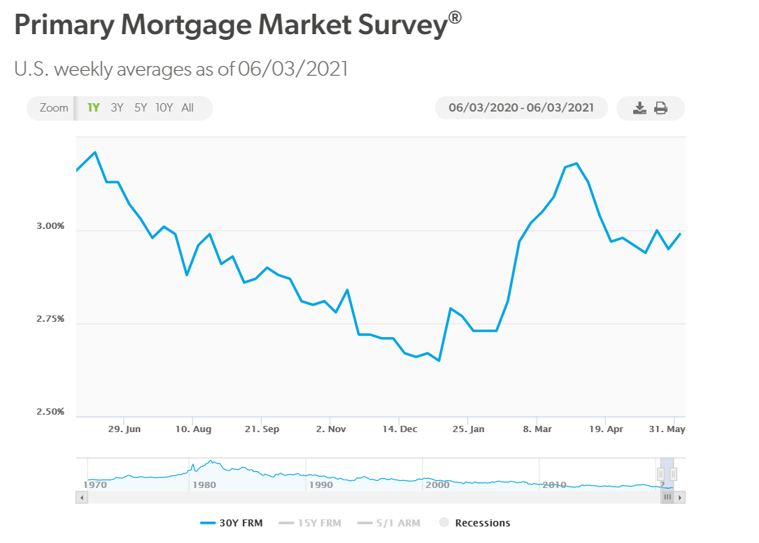

Mortgage Rates: 30-year mortgage rate is more quickly approaching 3.0% (and are now projected to hit 3.3% by the beginning of 2022)

-

Inventory Shortage: Housing Shortage remains large with the supply of homes available for sale down 20% year-over-year in April 2021.

Recent data does not indicate that either of these trends have started to reverse.

The 30 year Freddie Mac mortgage rate has not dipped below 2.90% since February (the rate had been below this number for most of the months when sales volume was rising month-over-month).

Source: Freddie Mac http://www.freddiemac.com/pmms/

Source: Freddie Mac http://www.freddiemac.com/pmms/

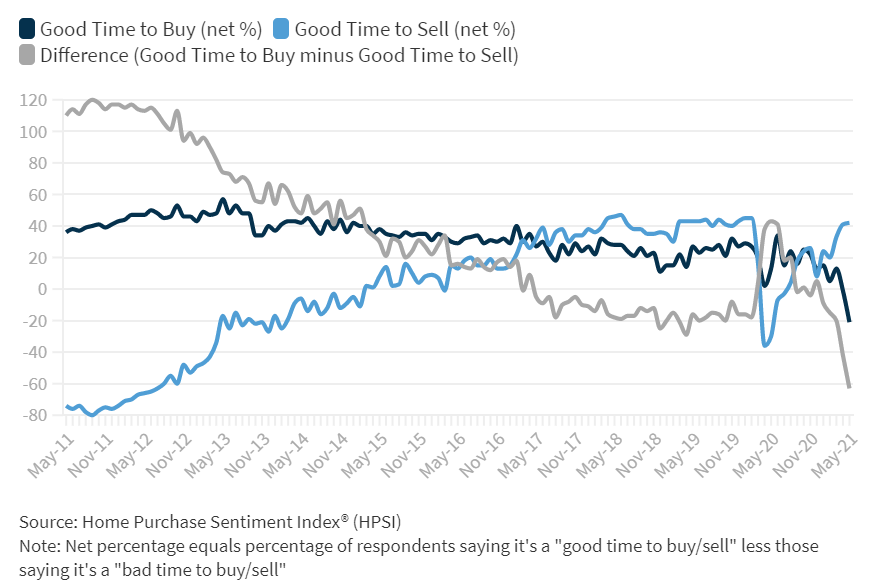

Due to the housing shortage in April, 47% of respondents to The Fannie Mae Home Purchasing Sentiment Index said it was a good time to buy a home, the lowest in the survey's history. The data came in even lower on June 7, with only 35% of respondents saying it was a good time to buy a home, another new record low. This reading is adding further concerns that the housing shortage is not showing signs of improvement.

Source: Fannie Mae https://www.fanniemae.com/research-and-insights/surveys/national-housing-survey

Source: Fannie Mae https://www.fanniemae.com/research-and-insights/surveys/national-housing-survey

There are also two other pieces of government legislation to keep an eye on that could really impact the market in the short term:

-

In April, Congress introduced a bill that would provide a $15,000 tax credit for first-time homebuyers targeting low- and middle-income earners. If this bill were to pass, it could have major impacts on pricing, particularly for more affordable homes priced below $500K.

-

The moratorium on single-family and real estate-owned evictions is scheduled to expire on June 30, 2021. It ended up being extended when it was last scheduled to expire in March. But if it is not extended again, it could add a temporary injection to the housing supply.

How Should Teams & Agents Prepare for a Potential Zero Growth Market Scenario?

Don't take this case the wrong way. This is not a prophecy of doom and gloom. This is not a prediction that the housing market is on the verge of an imminent crash.

All I am saying is that this zero-growth market scenario is increasing in likelihood. As such, it is imperative for many teams and agents to start rethinking their strategy to prepare for such a market. With a flood of new agents (due to the housing boom), the next 18 months are going to be significantly more challenging than the past 9 months. There will still be plenty of growth opportunities. Teams and agents will need to seek out opportunities other competitors are missing.

As such, the top-performing teams and agents that we work with are already starting to double down in investing time and resources in the following areas, and I would encourage you to do the same:

-

Focus on Building Your Seller/Buyer Pipeline NOW:

-

Make sure your cost per lead is competitive in your market and that you are not falling behind. You can benchmark your current performance with the following reports we recently published for Q1 CPL Trends we are seeing by market:

-

Waiting 3-6 months might be too late if current market trends continue. For those, who are ready to start building pipeline now, we are currently running a Summer Special Offer for Seller Leads (you can schedule a time here to discuss the offer with a CINC Product Expert) that will:

-

Capture Seller Leads Using Home Evaluation

-

Identify Seller's Interest with CINC AI

-

Nurture Seller Leads with CINC AutoTracks & Recently Sold Reports

-

Convert Sellers at the Listing Table with CINC Tools, including Buyer Match

-

-

-

Develop a Predictable Process for Closing New Business by Leveraging Existing Database: Geoff Adams, consistently performing in the Top 1% of all Realtors in Arizona, recently sat down with us to discuss the "Top 5 Money Makers in Your Database: 5 Actions to Take With Every Lead in Your Database to Grow Your Future Business."

-

Stay Up-to-Date on Best Practices From Top Performers in a Rapidly Changing Market: You can get a behind the scenes look at some of the new lead generation and conversion tools and processes some of the top performers in real estate are leveraging to keep a leg up on their competition by requesting a demo.

.png)