CINC's Facebook Expert, Harry Kierbow, is covering Facebook's recent targeting changes that impact the real estate and lending industry. He's breaking down how this will impact you and your ads! Join us as he breaks down the changes, who is affected, and how to continue dominating with your Facebook Ads.

Facebook’s frequent changes can leave you feeling a little, well… like this:

Fret not – CINC has your back! In this post, we’ll detail Facebook’s most recent targeting changes impacting the real estate and lending industry and some fresh, hot strategies to stay relevant using the new Facebook.

So… What Happened?

At the end of August, Facebook rolled out changes originally announced in March. These changes limited the targeting options available to those running ads about Housing, Employment, and Credit (HEC). It removed the ability to target your ads based on age, gender and zip code. Detailed Targeting was also severely limited by the removal of demographic and behavioral options previously available.

The changes impact any ad created after August 26 of this year. Campaigns that are running currently can continue running using their existing targeting until the end of 2019. However, any edits to an existing ad would require you to opt-in to the new targeting and make the necessary adjustments.

[RELATED] The 4 Best Social Media Strategies You Probably Don’t Know About (2 min. read)

What Industries Are Affected?

- Housing and Related Services: Examples include ads relating to housing or home services including home sales, home rentals, insurance, loans or other related services.

- Employment: Examples include ads promoting or linking to employment opportunities including ads for internships, professional certification programs, job fairs, and job boards.

- Credit: Examples include ads promoting or related to credit opportunities like credit cards, auto loans, mortgages, long-term financing or personal/business loans.

CINC's Cost Per Lead is now more the 20% better. Find out what the Cost Per Lead is in Your Market!

Update from January 2020

As of August 2019, advertisers running ads within these verticals were required to self-report the ad’s type and opt into the limited HEC targeting. Facebook began disapproving new or edited ads that promoted HEC opportunities but weren’t built using the new targeting.

Ads that were running before the enforcement date will continue running unless they are edited. Facebook just confirmed via email that these existing ads will be allowed to run unedited until February 11, 2020. At this point, ads that target HEC opportunities and have not been opted in will be paused until they are edited for compliance.

New non-compliant ads within the HEC verticals submitted after the August 2019 enforcement date would be disapproved outright by Facebook.

If an existing ad is edited after August of 2019, it will be submitted to Facebook Ad Approvals again and will be denied if it is non-compliant with the new HEC targeting. All existing ads must be updated by February 11, 2020.How to Opt-In to the New Targeting

If you are running ads for housing, employment or credit (mortgages, credit cards, etc.), you’ll want to follow this process for any new ads you create and for any existing ads you have to edit.

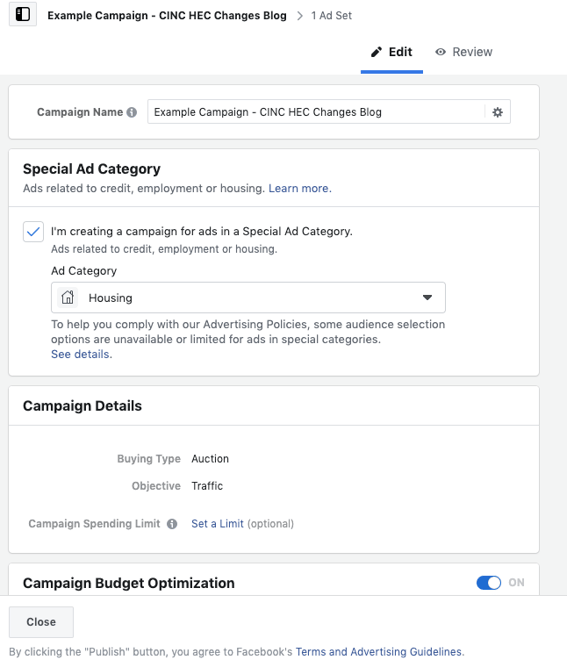

1. Opt-in to the New Targeting Modal at the Campaign Level.

At the campaign level, check the box that says “I’m creating a campaign for ads in a Special Ad Category.” Then select the appropriate choice (Housing, Employment, Credit) from the dropdown that appears after you select the checkbox.

After doing this, the only options you will have going forward will pertain to the new ad targeting, and step 1 is complete! Now, complete the other necessary fields for your campaign (budget, bid strategy, etc.).

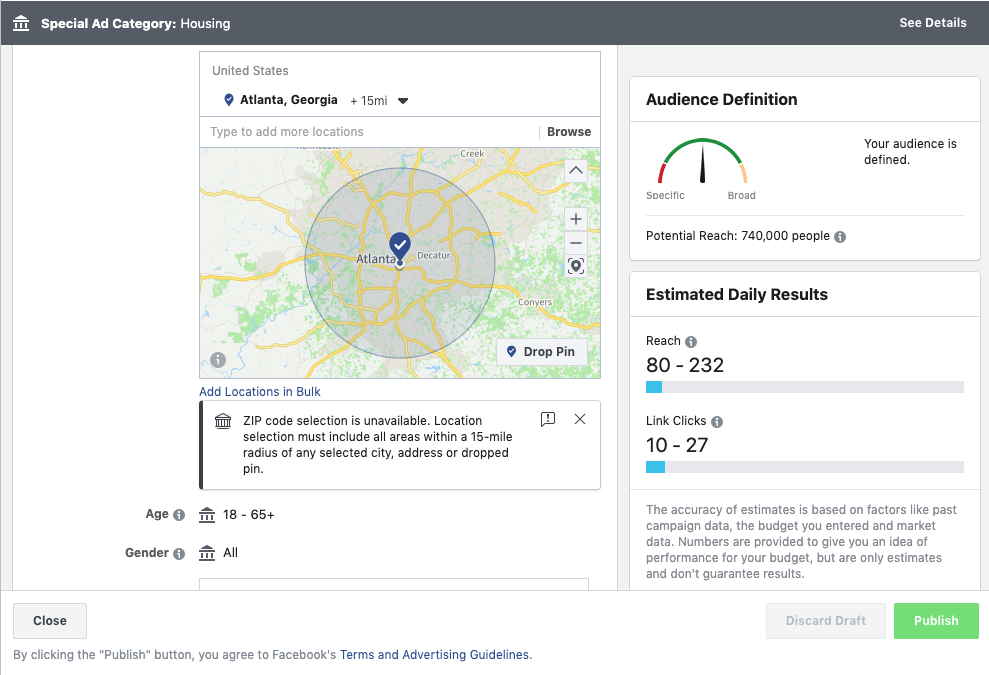

2. Set Your Ad Targeting Using the New Options.

You won’t notice any huge changes once you click into the ad set level, but they’re there. The changes from Facebook were largely intended to make sure that Facebook advertisers were not abusing protected classes. To this end, Facebook removed many targeting options that you may have used. These include:

- Location: Ads can still be targeted to Facebook Users by geographic location (country, region, state, province, city or congressional district), but not by ZIP code. Specific locations will include a 15-mile radius around that targeted city, address or pin-drop.

- Age: All audiences for HEC advertising must include ages 18-65+.

- Gender: All audiences for HEC advertising must include all genders.

- Detailed Targeting: Behavior and Demographics Detailed Targeting options have been removed. Interest targeting options still exist but have been extremely limited.

- Exclusions: You can no longer exclude Facebook Users based on demographics, behaviors, interests, etc. You can still exclude custom audiences.

- Special Ad Audiences: Lookalike Audiences have been replaced by Special Ad Audiences under the new HEC targeting rules. Special Ad Audiences are similar to Lookalike Audiences but reference fewer data points.

Find out more about Facebook’s new Special Ad Category targeting here.

3. Create Your Ad(s).

At this point, the ads creation process is pretty much the way it’s always been. Build your ad, hit ‘Publish’ and you’re done. You’ve created your first ad using Facebook’s new HEC targeting options! Way to go!

How Should You Change Your Approach?

Remember the days when we used to be able to target ‘homeowners’ and ‘likely to move’? Oh, those were the days!

Now, you have to put your thinking hat on if you’re going to target cold traffic with Facebook and Instagram. The good (and bad) news is that there are now so few demographic targeting options that it’s easy to scan the list! Utilize interest options like ZTR, House Hunting, Pre-qualification (lending), Mortgage calculator, and more to target real estate.

[RELATED] The Newest Real Estate Social Media Strategy You Probably Aren’t Using… (3 min. read)

With this change though, your job description has become a bit different. The new Social Media Marketer’s focus should not be primarily on driving new, cold leads but instead on building audiences. Use cold traffic ads to drive people to your site and then get to retargeting! Use powerful Facebook ad types like Dynamic Ads for Real Estate or drive your leads down the conversion pipeline using funnel-based advertising. Find your highest-converting, highest-value leads and then create Special Ad Audiences (formerly known as Look-alike Audiences) to drive more people like that with your cold ads, then retarget them, rinse and repeat. You got this!

Want CINC to manage your Facebook Ad Campaigns?

.png)